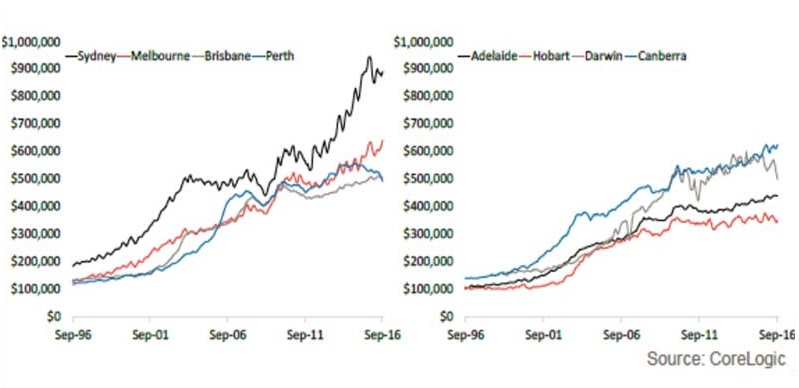

It can be misleading to view the Australian property market through the success of the East Coast market. With both Sydney and Melbourne experiencing rapid median house price growth, it makes for a good news story for those who got in at the right time.

Quarterly median selling prices of houses across the capital cities

While the West Coast saw significant growth during the peak of the mining boom in 2003-2006, prices has plateaued since then.

While there are signs of recovery in Perth, it’s clear that the East and West coasts are experiencing completely different levels of confidence, demand and housing activity.

ABS numbers from 2016 Q3 indicate that over 9,000 people have left Perth, heading back to the East coast after enjoying the peak of the mining jobs. While this exasperates affordability issues on the East Coast, it also equates to fewer buyers and more supple in the WA market – both forces putting downward pressure on median house prices.

For those fortunate enough to have stable employment in Perth, are self-employed or can work remotely, the Perth and surrounding market presents a wonderful opportunity to purchase property. With a median house price 45% lower than Sydney and 27% lower than Melbourne, capitalising on West Coast housing affordability could prove to be the remedy for difficulties entering the East coast market.

For first home buyers or those looking to purchase an investment property as their first purchase, Western Australia can offer attractive rental yields without the burden of saving for a huge deposit or asking your family to sign on as guarantors to the loan.

Similarly, if buyers can avoid Lender’s Mortgage Insurance then it can prove to be a profitable decision on all fronts. When considering a move to Perth, Rockingham or a West Coast town, make sure to speak with one of our Mortgage Specialists here at Smartline Rockingham.